How To Find & Secure Profitable Deals In Hot Markets [Training Recap]

Wow! Our “How to find and secure profitable deals in hot markets” live training last week was a MASSIVE success.

The webinar room was full to capacity and many of you emailed me asking for a replay as you couldn’t grab a seat on the live training. And boy, have you missed a good one!

Here’s some feedback I received shortly after the training ended:

As you know, the replay of this training is generally only available to Ultimate Property Hub members…

…BUT since we were completely sold out… and as many of you wanted to attend and couldn’t… I decided to share with you today the key takeaways from our Thursday night training.

Ready?

Kate showed up to the Property Launchpad with no experience. Now she's set to make $100k in the next 12 months!

Want to do the same? Apply now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

How To Find & Secure Profitable Deals In Hot Markets

The training session was broken up into 3 training modules:

- The ‘5 Irons in the Fire’ system I use to ensure that profitable property deals are coming my way

- My ‘3 Pronged Approach’ to getting deals flowing to you so you’ll never be in a static phase waiting for things to happen

- What to do once you find the deal

Here we go:

Module One: 5 Irons in the Fire

1. Letter box drops:

This is a bit of a shotgun approach with about a 1% return on your investment meaning 1 out of 100 people might call you back showing interest.

It can cost about $1000 to pay a junk mail delivery person to drop your flyer into a couple of thousand letterboxes.

I like to leverage this a little further and use PriceFinder to target owners with properties that I’m interested in. Even if they’re not for sale, you never know how close owners are to putting their property on the market.

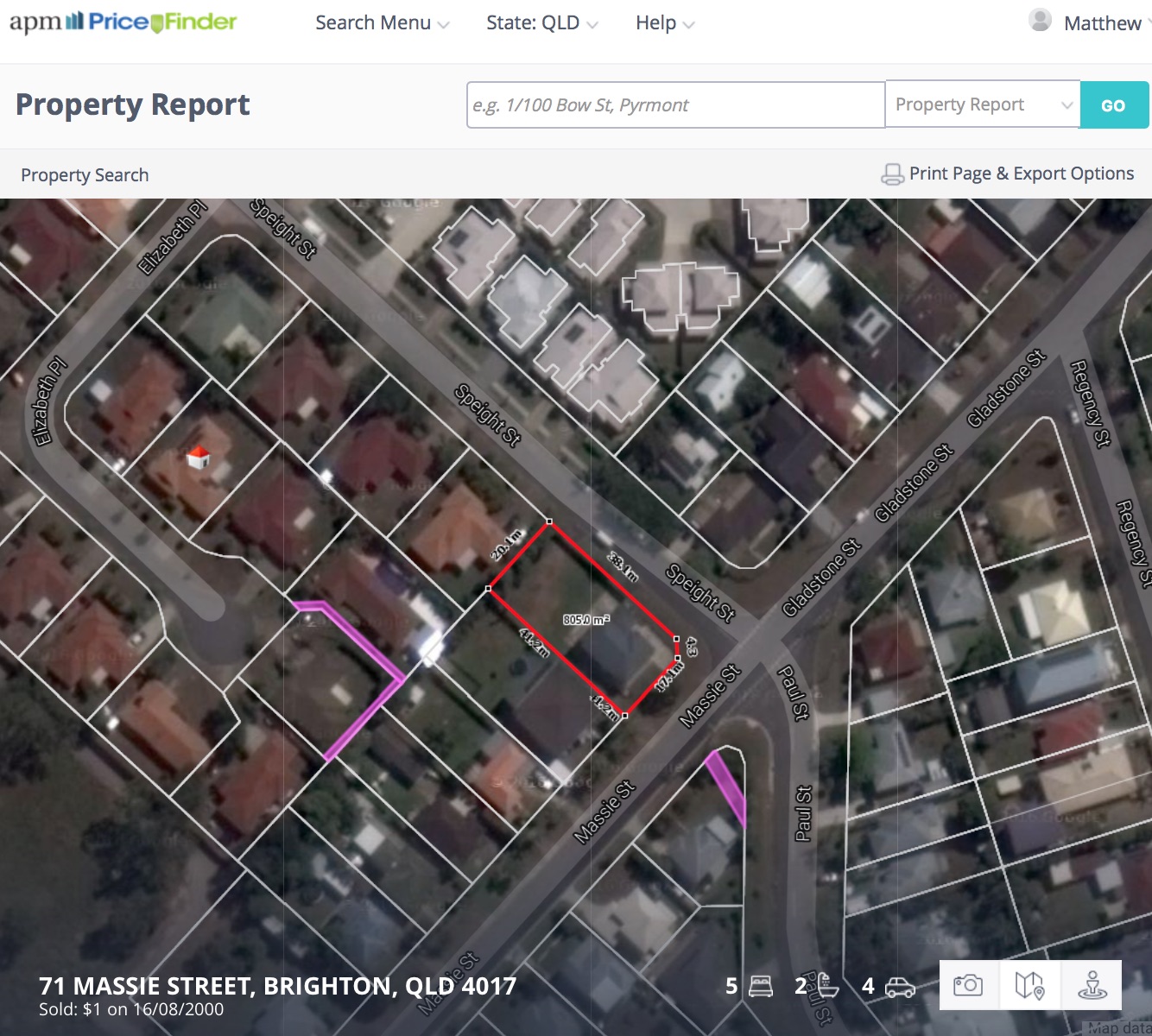

For example, if you’re looking for subdivision opportunities, PriceFinder will spit out a list of potential subdivision sites if you filter a suburb down to properties with a lot size of over 800m2 (or double the minimum lot size in your area). From there you can target those specific properties by posting a letter, dropping a flyer in their letterbox or have an agent contact them on your behalf.

2. Talk with and educate agents:

Get crystal clear on what type of deal you are looking for so that you can articulate what you want to the agent with clarity.

If an agent brings you a deal, work with them and educate them as to why or why you don’t want this deal. Show them your numbers and provide feedback. Nobody does this so you will stand out from the crowd by giving them your time.

Show your appreciation when agents bring you potential sites. Reward them with a small gift (like a box of chocolates or movie tickets) to show you are grateful for them bringing you a deal. This builds rapport and encourages them to bring you more deals – especially crucial in hot markets!

3. Look outside your property circles:

The beautiful thing about property is that there are always buyers and sellers in any market – hot markets and cold markets alike!

There are always reasons for people to buy and sell no matter what. Divorce, deceased estates, downsizing, upsizing and many other personal circumstances motivate people to sell or buy property. Your job is to keep an ear to the ground so you can help those that need to trade their properties for something more appropriate.

It could be at a BBQ, waiting in line at Woolies or networking with others at the gym. Just remember this mantra, “You are in the right place at the right time with the right person for the right deal.”

4. Networking Groups:

My favourite of course! Consistently attend property networking group meetings to hang out with other like-minded property investors.

If you don’t have one in your area, start your own! You only need one person to begin and it will grow from there. We now have 3000 in our networking groups which all started with 6 people going out to dinner one night.

The key is to attend on a regular basis and stay accountable with others to ensure you show up.

5. Use PriceFinder or another paid online researching tool:

If you’re serious about property investing, at some point you’ll need to invest in one of these paid resources.

Programs like PriceFinder are like x-ray vision for property investors and will keep you ahead of the pack by accessing:

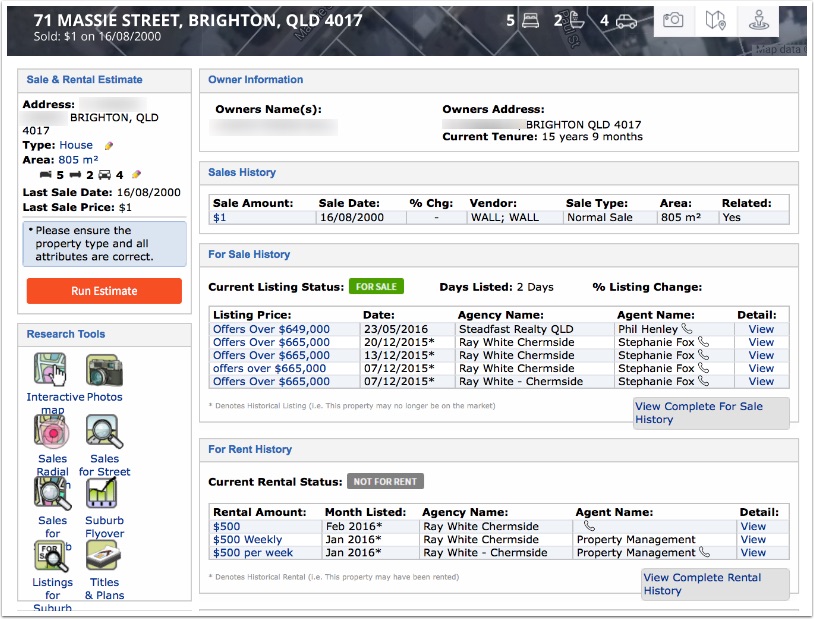

- Past sales history (which is great for working out vendor debt level)

- Comparative sales in the street and suburb at the click of a button

- Specific filtering tools to find development sites and splitter blocks

- Advanced search functionality to find motivated sellers

Pricefinder is my weapon of choice as the data is second to none and can be used by anyone that knows how to turn on a computer. Check out my comparison of Australia’s top property research tools here and choose the one that’s right for you.

PriceFinder saves me hours of wasted time because I can filter out the dud properties from the golden opportunities without leaving my desk. If you haven’t seen it yet, check out the How I use PriceFinder [Video Guide] now.

Jim Valery shares his Property Launchpad experience!

Do you want simple, predictable, big-time property profits? Save your seat now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

And did you know that our Ultimate Property Hub Membership provides you with the opportunity to access PriceFinder at a massively discounted rate (saving you $1122 per year)

With 5 Irons in the fire your ability to start accessing deals even in hot markets should start to flourish.

Of course there are other avenues to bring deals but the above strategies are at the top of my list. Let’s move on to the second training module to show you how to find and secure profitable deals in hot markets:

Module Two: My ‘3 Pronged Approach’

To become a successful full time property investor that can sustain multiple market swings you need a method that will bring you opportunities to access profitable deals on a consistent basis.

Having deals consistently come across your desk means you’ll never be in a static phase waiting for things to happen. Ultimately you would be acquiring one deal, while managing a second project and selling a third to build strong momentum.

A. Prong One – Don’t Just Focus on Retail Websites

Nhan Nguyen, one of my mentors recently told me that buying deals using realestate.com.au or domain.com.au is like buying at David Jones – you always pay retail. That’s not to say you won’t find opportunities there but it’s not a great place to search unless you have clear idea on what you are chasing.

Most people tend to waste a lot of time doing random searches for deals on ‘retail sites’ (usually after work or late at night which yields little results due to your frame of mind).

Those that happen to stumble across an opportunity take no action because they haven’t laid out a plan of attack on what to do next… instead they print it out, put it in the top drawer and move onto the next bright shiny object.

This type of random searching for deals tends to lead to distraction, boredom and becoming disheartened with your efforts.

The truth is, if the deal is on the internet it’s probably too late and not worth pursuing in hot markets. Prong 2 and 3 shows you some more efficient options to implement.

B. Prong Two – Become an Area Expert

The goal here is to know your area (I’m talking between one and three suburbs) better than anyone else… even the agents!

This will instil confidence in your deal assessment process and ultimately lead to faster decision making, improved number crunching skills and better rapport with real estate agents.

Here’s a simple process that will ensure you become the guru in your area in 30 days:

- Buy a 200 page journal and start tracking every deal you look at. Include cutouts of the deal, number crunching and any conversations you have with the agent.

- Attend as many open for inspections (OFI’s) as you can. At least 5 a week.

- Talk to as many agents as you can by calling them up, visiting their office and attending their OFI’s. Educate them on the type of deal you are seeking and reward them for their efforts (see 2nd Iron in the Fire in above training module)

- Aim for 100 deals and in no time your journal will become a scrapbook jam packed with on the ground self training that will give you the street smarts to out muscle other investors when push comes to shove.

Does it work? Check out this subdivision Case Study: $850,000 Profit From A Single Deal to find out 🙂

C. Prong Three – Targeting Agents

No matter what your opinion is of real estate agents, bear in mind that your most likely source of property deal opportunities will come from agents…. So start befriending them!

Pay each one a personal visit in your quest to becoming an area expert. Introduce yourself, explain what you’re after and start building rapport. Attend their OFI’s, touch base once a week and expect to find one in ten that will see the benefit in assisting you.

Additionally, target these 3 types of agents in the market:

- Look for agents selling premium, million dollar properties with a cheap, unattractive listing.You’ll find these guys are used to higher commissions and a dud listing is like a thorn in their side; they’ll be more motivated to get it off their books, potentially at a discounted price.

- Take note of tired agents that have been in the game a long time and don’t want to work hard for the sale. They’ll look to take the easy route by conditioning the vendor down in price.

- If you see a property listed with an out of area agency that suits your strategy, jump on it.The agent probably may not know the area or the value of their listing and the property is often a pain for them that they’re happy to get off their books.

Module Three: A Plan of Attack

If you’re going to implement a process to have profitable deals flowing your way, you need to have a system to deal with them and sort the wheat from the chaff in an efficient, proactive manner.

Most investors just browsing a retail site like realestate.com.au dont actually know what to do when they find a potential property deal, or they don’t have the confidence to take action…. so they do nothing.

There is no pressure to take action when you find a deal, especially if you don’t have a mentor or accountability buddy, so you need to create that pressure within yourself. Tap into ‘your why’ for motivation at this point.

Formulate a checklist of tasks to arrive at a ‘go’ or ‘no go’ type of scenario. Here’s my plan of attack that ensures I take immediate, consistent action every time I come across a potential property deal:

- Login to PriceFinder and pull up some broad specifics of the deal.Critical information such as land size, site dimensions, dwelling location on the block, easements on the site, frontage and setbacks all assist with the initial tick and flick of the site.

![PriceFinder-Map-acreenshot]()

From there I’ll check out who owns it and whether they are an investor or owner occupier. I’ll look at what they paid for the property and when they purchased it which helps with understanding how much debt might be left on the property so that I can structure a quality offer.![pricefinder-property-details]()

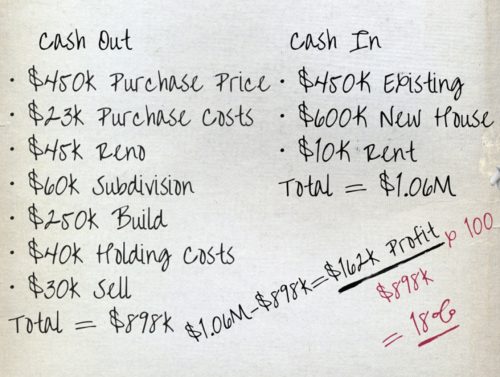

If I’m still interested, I’ll have PriceFinder spit out some market estimate reports, rental history and comparative sales in the street and suburb. - My next port of call is to crunch some basic numbers on the deal. Nothing complicated, just a quick back of the envelope feasibility.

Tip: Always look at worse case scenario. For example, if I’m assessing a subdivision site that I know I can subdivide from one into two that creates a front lot with a house and a rear vacant lot, I’ll do the numbers on selling both sites immediately after the new lot titles have been issued.

I like to touch base with the town planner from the local council first to get an indication (and that’s all it is) on how they feel about the proposed subdivision. Again if I’m looking at a potential subdivision, I’ll pick up the phone, call the council, ask for the town planner and pose questions like:

- What’s the location of sewer and water infrastructure?

- What’s the minimum lot size and frontage in that zone?

- What overlays might hinder the project? Eg Heritage or vegetation restrictions.

- Is there a precedence for this type of approval in the area?

- Do you think I’ll need a pre lodgement meeting?

Once I have the answers, I’ll call a private town planner and ask the exact same questions with a view to acquiring more factual information that I can make decisions with.

By educating yourself and creating a process before you start, you stand a much better chance of success rather than setting yourself up for failure.

Congratulations once again to everyone that made it into the webinar room for this outstanding online training. Those of you that have webinar access via your Ultimate Property Hub Membership – stay tuned for another instalment next month!

There’s no time like the present to start setting up your pipeline. Take the first step today and before you know you’ll have an abundance of profitable property deals flowing in your direction!

Peter Baumann shares his Property Launchpad experience!

Do you want simple, predictable, big-time property profits? Save your seat now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

Awesome information, I love following your blogs.

Thanks for the feedback Theresa. Glad you are enjoying the information. I’m enjoying writing it and there is plenty more to come 🙂

Hi Matt,

How do you structure a quality offer simply by knowing how much the vendor paid for the property and when they bought it? Some vendors may have refinanced or added more debt to their mortgage which makes it hard to structure an offer.

Hi Gavin. That’s true you can really only use it as a guide. From there you need to dig deeper about what the vendor’s needs are. For example finding out why they are selling, where they are moving to next, if they’re downsizing, upsizing etc. The more you can find out about the vendor’s practical, emotional and financial needs, the better your offer will be

I’m liking what i’m reading Matt! You explain it all in a way i can understand it. I’m now going to see if i can find more of your training. Thanks, Greg.

Good stuff Greg and thanks for the feedback. Check out my membership site, Ultimate Property Hub… there is a 30 day trial for $1 if you want to have a look around:https://www.propertyresourceshop.com/sp/onedollar/

Cheers, Matt