How To Find The Best Investment Property Loans In Australia

Did you know that in Australia there are five different ways to get investment property loans?

Each way has its pros and cons. So how can you choose the best lender for you next purchase? Read on to find out.

Matt Punter, mortgage broker extraordinaire and founder of The Savings Centre, recently did an outstanding presentation at one of our property networking group meetings showcasing his unique approach to finding the best investment property loans for his clients.

After watching a replay of the presentation in the Ultimate Property Hub membership sit, I just knew this information needed to be shared.

So, instead of just shoving a 45 minute video up here to watch (let’s face it, who can really stay focussed for that long looking at a computer screen?!) I’ve chosen the section that provided the audience with the most benefit:

Kate showed up to the Property Launchpad with no experience. Now she's set to make $100k in the next 12 months!

Want to do the same? Apply now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

Understanding The 5 Different Investment Property Loans Options For Funding Your Next Project

The majority of borrowers out there are lead to believe by the banks that there is only one way to get an investment property loan:

- Saving for a deposit

- Borrow the rest from a bank by leveraging off your income

That excludes a multitude of potential investors and homeowners that want to borrow money and get into the market.

For example, what happens if:

- You’ve just gone out on your own and started a business or become self employed and have no financial documentation to prove your income generation potential

- You have a stack of savings but only a low paying part time job to leverage off

- You have a high income but zero savings to contribute to the deposit.

- The bank has a black mark against your name because you paid your electricity notice three months late back in 1993 because you were overseas and didn’t receive the bill

These are all real world challenges that everyday people face when looking to get an investment property loan and get into the housing market.

Back in my 9 to 5 days, I used to think saving a 20% deposit coupled with begging and borrowing for the other 80% was the only way forward… well times have changed!

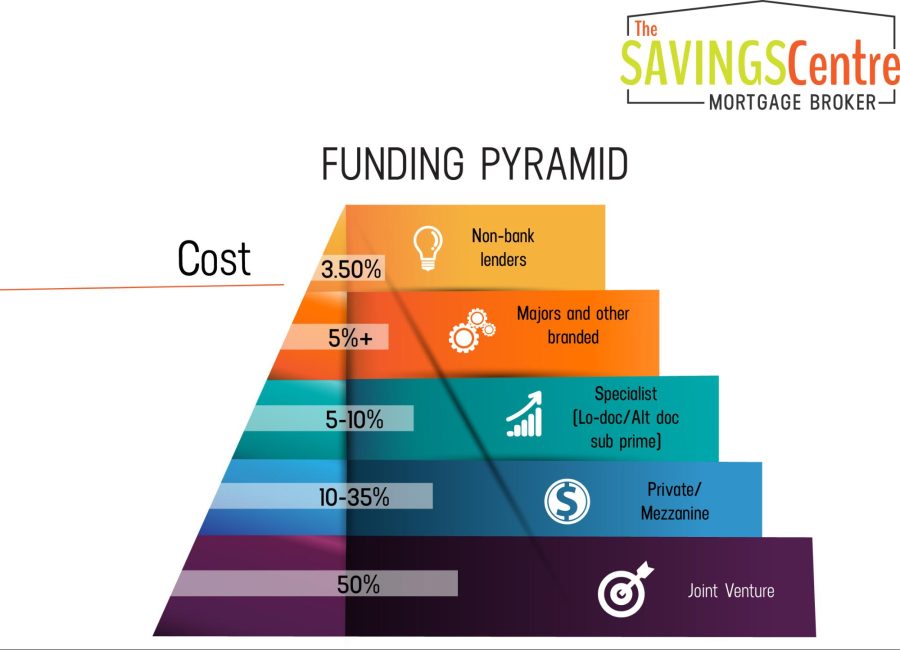

Lucky for you, Matt Punter has a terrific system called ‘The Funding Pyramid’ (which has nothing to do with pyramid schemes of any kind!). This system clearly outlines the whole range of financing opportunities that can be implemented – depending on your circumstance.

Using ‘The Funding Pyramid’ To Find The Most Suitable Investment Property Loans

You’ll notice a percentage allocated to each tier of the pyramid in the image above. This percentage relates to the average interest rate the associated lender can provide to its clients.

Let’s go through the 5 steps of the Funding Pyramid now and detail how each type of lender institution structures their business and how that can benefit you on your next finance application.

#1: Investment Property Loans From Non-bank Lenders

These guys are the low flying ‘stealth lenders’ in the market and in fact, most people will never have heard of them.

They don’t spend any money on their branding and they generally don’t have offices. What they actually do is piggyback off one of the larger financial institution’s business systems and predominantly do all their business online.

Essentially, non-bank lenders don’t have a lot of overheads and work on very thin profit margins. They can then pass those savings onto their customers, hence them being at the top of the pyramid with the lowest interest rate.

#2: Using Major Bank Lenders For Your Investment Property Loans

We’re talking here about the Big 4 financial institutions that do the majority of ‘Mum and Dad’ lending.

Those that aren’t exposed to the many financing options available tend to go with the big banks because they are trusted and have more or less stood the test of time.

That trust comes from expensive branding and emotion driven marketing campaigns so bear in mind that the cost of that promotion needs to come from somewhere.

Which is why they are the next level down the pyramid when it comes to affordability.

#3: Investment Property Loans From Specialist Lenders

Jim Valery shares his Property Launchpad experience!

Do you want simple, predictable, big-time property profits? Save your seat now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

You may have heard these service providers called, Low Doc, Alternative Doc or Sub Prime lenders.

This is where borrowing becomes a little more accessible for those that don’t fit into the square box that the major lenders expect for reasons I detailed in the above four dot points.

Yes, you may pay a little more to access these loans but at least it allows you to move forward with your property acquisitions.

I know I’d rather pay an increased interest rate of 2, 3 or even 5% to get access to half a million bucks if it meant I could leverage off those borrowed funds to generate a $100k profit on a subdivision project!

#4: Investment Property Loans Using Private or Mezzanine Funding

This tends to happen a lot in the development space and is not often heard of in the mainstream lending market.

There’s a real need for this type of funding because traditional lending will rarely fund the entire cost of a complete development project.

For example, a major bank might fund the purchase of a block of land, the construction costs of developing the site but may not contribute hard costs such as consultants fees, quarterly GST payments or council fees and contributions.

In order for that deal to be completed, the investor may use mezzanine finance or private lending to bridge the financial gap.

These finance options are generally short term but provided at a higher borrowing cost which again comes back to the quality of the property deal and whether it’s feasible to take on extra borrowing costs.

If you’d like to learn more about this type of lending, let me know in the comments. I have a comprehensive interview with Mezzanine Finance expert, Giulian Gastaldon available for those of you who are interested.

#5: Using Joint Ventures To Fund Your Purchase

This strategy takes funding deals to a whole different level and goes one step further than private funding.

Joint venturing is where multiple parties bring specific resources to the table that allow a particular project to become a reality.

Those resources generally boil down to four things:

- The ability to find a profitable deal

- Cash or equity to fund the deposit or ‘add value’ strategy EG. subdivision costs

- Servicing capacity to borrow money from a financial institution

- Skill to project manage the deal to a profitable outcome

You’ll notice joint ventures are not just about borrowing money however it is a big contingency of how the deal is structured.

Don’t be deterred by the high percentage associated with joint ventures in the Funding Pyramid. If the deal is good enough, I’ll always take 50% of something than 100% of nothing.

Joint Ventures can be done at any point in your investing career.

Once you learn the strategy of successful joint venturing, accessing funds for projects becomes far more accessible and allows an infinite amount of leverage on your time and money.

To learn more about this strategy, check out the DIY Joint Venture Kit inside the Ultimate Property Hub membership site

The Bottom Line

When it comes to financing property deals, you can see there are many creative avenues to get your deal over the line.

Don’t be put off by a lender rejecting your application. With so many finance products available these days, a ‘no’ is just a response from one lender at that particular time for that particular product.

Always explore other options to finance your project.

About Matt Punter

A Mortgage Broker is in my top seven people you need on your property investing team and I consider Matt Punter from The Savings Centre to have extraordinary skills and experience in helping investors fund their projects.

Matt is someone that KNOWS how to find money so If you’re struggling to get a finance application through or a deal that just doesn’t tick the traditional lending parameters, Matt’s your man.

Matt and his team are based on the Sunshine Coast, Queensland and service clients all over the country. You can contact Matt to organise an initial free 20 minute consultation by contacting him at http://www.thesavingscentre.com.au

Peter Baumann shares his Property Launchpad experience!

Do you want simple, predictable, big-time property profits? Save your seat now!

Property Launchpad - your ticket into the highly-profitable world of Joint Ventures!

I’d be interested in seeing further information on mezzanine finance. Many thanks Louisa

Sure thing Louisa. I’ll send you a link to the download page soon. Thanks for the comments and interest in Mezz Finance. Cheers, Matt

Hi Matt. Hoping that you are enjoying autumn in France and are not eating too many of those delicious pastries and croissants!

I would be interested in listening to the comprehensive interview with Mezzanine Finance expert, Giulian Gastaldon if possible, please?

Thanks and regards,

Simon

HI Simon. Thanks for the comments and yes it is a magical time of year here in France. The pain au chocolats are still my weakness but I’ve started running again so I expect that will counteract it 🙂 I’ll send you the link to my interview with Giulian via email mate. Have a great week! Cheers, Matt

Hi Matt

As always a well written and great read, can you please get in contact with me about #3 specialist lenders

Keep up the good work

Hi Matt,

I’m very interested in finding out more about Mezzanine lending, any chance of getting the link sent to my via email.

Regards

Thanks for the comments Karl and have emailed you a copy of the interview. Let me know how you go 🙂 Cheers, Matt

Hi Matt,

Great read, can you please send me the link for the comprehensive interview with Mezzanine Finance expert, Giulian Gastaldon.

Thanks

Regards

Neil Wendt

Sure can Neil… I’ll have it emailed to you mate. Cheers, Matt

Hi Matt

Would you please be able to email me the interview recording with Giulian Gastaldon.

Thanks.

Hi Matt,

Is this interview still available?

Mal

Sorry Mal, this resource has been taken down. I will be organising to have Giulian or one of his private finance colleagues at the upcoming JV Bootcamp if you want to join us there? Here’s the link: https://www.propertyresourceshop.com/sp/jv-bootcamp/ Cheers, Matt